Whether you like or despise finance, it is indirectly part of your life. Everything you do has to do with mathematics. Meaning, it has to do with numbers, so get acquainted with them. If you are person who stresses out a lot and checks frequently their online banking, do not panic. There are super-friendly and easy-to-use apps that will break down your expenses in an intuitive way. The next sections will outline spending tracker apps that will alleviate your worries, anxiety and obsessions of how to organize your money.

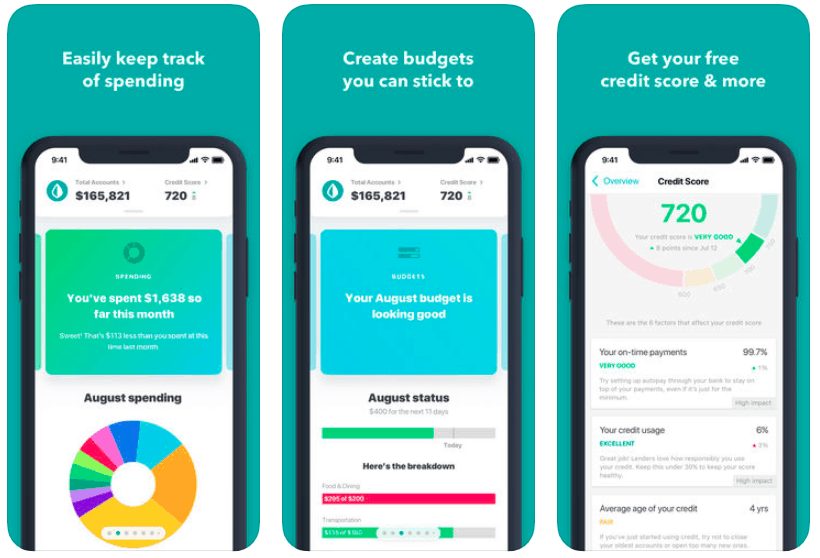

1. Mint

Mint was founded in 2006, and is an award-winning service. It offers a comprehensive experience that is free, fast and super easy. The capabilities include budgeting tools, alerts, credit scores, mobile support and compatible with Apple Watch. The support is limited to the United States and Canada accounts. Overall, it is a personal finance service with a wide range of resources to users who can track their spending and budgeting, which will calculate your net worth. Your net worth is calculated by connecting all of your online finance accounts and verifying your credit score. Get Mint here!

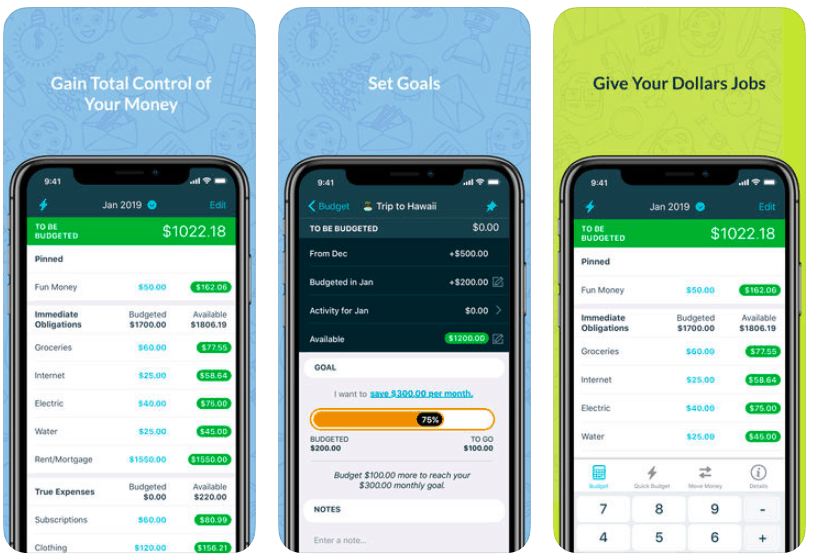

2. YNAB

YNAP stands for You Need a Budget and was founded in 2004. It is a great and personal budgeting app that is built on a solid approach. It is deemed flexible, and offers users educational tutorials to manage finances in a coherent manner. Also, it has a great web interface. However, it takes time to learn the platform. And this spending tracker is relatively expensive and has no free versions. Get YNAB here!

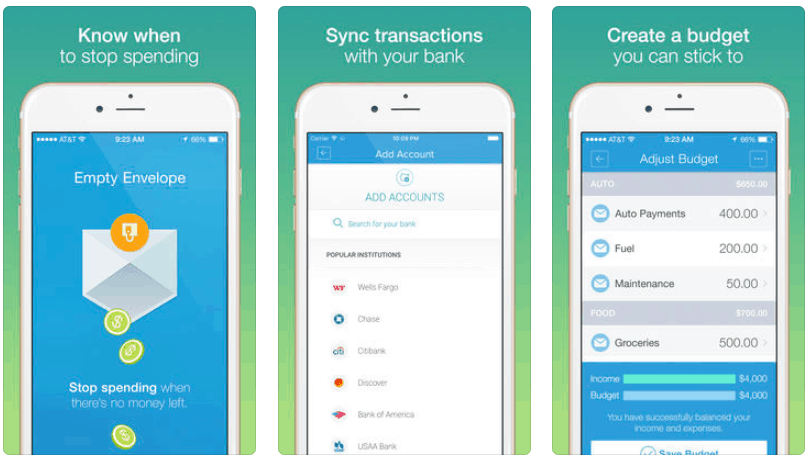

3. Mvelopes

Mvelopes was founded in 1999. It utilizes a principles of personal finance budgeting and based on the envelope system of allocated spending. It can also roll-over monthly budgeting, which is supported. Ultimately, it helps you the consumer put savings or envelopes away, so you can have financial freedom. The drawbacks, however, are that it is time-consuming to get up and running. The interface is dated and the cost of upgrading is not clear with different premium versions. Get Mvelopes here!

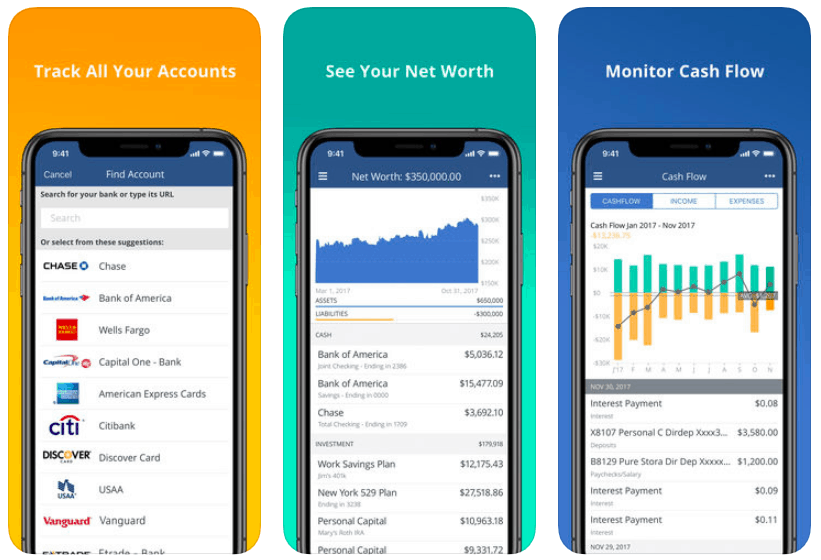

4. Personal Capital

Personal Capital was founded in 2009 and it is a billion dollar company. The service is regarded as one of the most popular financial management platforms. The app has a free, Free Financial Dashboard, and a paid, Wealth Management Service. The pros of the app are budgeting and investment management are all available in one platform. In addition, it includes investment tracking and socially responsible investing. But for Wealth Management, it requires solicitation, high fees and has limited budgeting capabilities. Get Personal Capital here!

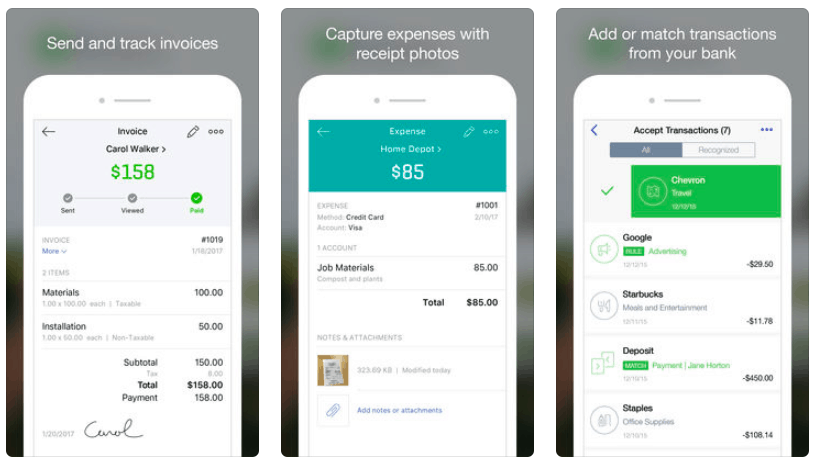

5. Quickbooks

Quickbooks was launched in 1992 on the IBM on Microsoft DOS and Apple’s Macintosh. The software accounting program comes in various versions and editions for small to medium-sized businesses. It can be managed from anywhere at anytime, and it is very easy user-friendly. It can help organize everything from your books, manage expenses, send invoices, track inventory and run payroll. Beyond the expense tracking, Quickbooks has been adopted by lots of different companies across every industry you can imagine. So this app is particularly recommended for any business owners. Get Quickbooks here!

The Bottom Line

When it comes to managing your money, it is important to become educated and financially responsible. The messages we are bombarded all around us are constantly associated with spending, and buying. Nevertheless, the messages we should be getting have nothing to do with saving you money. Before making unnecessary expenses and purchases, read the fine print. All of these services have free or paid versions to assist you with your money-saving schemes. Ask a lot of questions before making any commitments. Search up free financial consultants or advisors to get a sense of where to invest and not spend your money. It is very easy to get in debt, so do not live on credit cards unless you can afford to pay them. Use these apps to live within your means and allocate savings in safe investments that will help you in the longterm. Featured photo credit: Alexander Mils via unsplash.com